DTC brands: scrap your scrappiness!

Why DTC brands' scrappy approach to retail expansion costs more than it saves

The tl;dr

Building business cases for leadership hires can be tough, especially for brands with limited budgets who prefer to “figure it out” on their own

Retail expansion requires lots of time and money, and locks you into decisions for up to a decade; leaving dozens of opportunities to make mistakes that you make before sales even start, and that you can’t undo

The (opportunity) cost of staying scrappy can cost ~$50,000…per lease (and that’s just for the first lease year)

Depending on how much of a gap you believe there is between inexperienced and experienced operators, even if you’re only opening 1 store without a seasoned operator then you might be burning more cash than you would if you had one

1REC offers fractional Store Development leader support at…well, a fraction of the cost of a full time here!

Retail is a risky business

Retail is a unique channel in a number of ways, and the attribute that I’m spotlighting this week is its riskier timing of cash flows.

Let’s start with a mathematics concept. There’s a set of definitions in mathematics that labels variables as Discrete or Continuous:

Discrete variables: there is no “in between”

Continuous variables: there is an infinite number of “in between” possibilities

I like to apply this to a retailer’s growth spend across two common buckets of sales-generating investments:

New stores: you can open 1 or 2 stores, but nothing in between

Digital marketing: you can spend $100, $100.01, $100.02…up to infinite, and with an infinite number of possible decimals

I like this application because it illustrates one of the fundamental challenges with retail:

because each individual store is all or nothing, you have to commit to the decision with 100% conviction or back out.

And if that wasn’t enough, you spend almost 100% of the total investment cost before the store is even open and generating sales.

In short, you have little to no room to pivot. Sure, you can pivot between store openings, but you’re still out hundreds of thousands of dollars between each opportunity to do so.

Even if you stop construction halfway through, you’re still legally obligated for the full term rent if you signed the lease.

Investing in retail doesn’t afford you the opportunities to pivot that digital marketing does.

What if you could do 5% better?

When you’re cash strapped as a DTC startup, building the business case to bring in experienced leaders or consultants can be a tough sell. “We have to stay scrappy” or “we can figure it out on our own” are common reactions from DTC leaders when prompted with the request to bring in experts in any functional area. I’ve even heard (and said in several contexts) “The cost of our mistakes will be less than the cost of a consultant.”

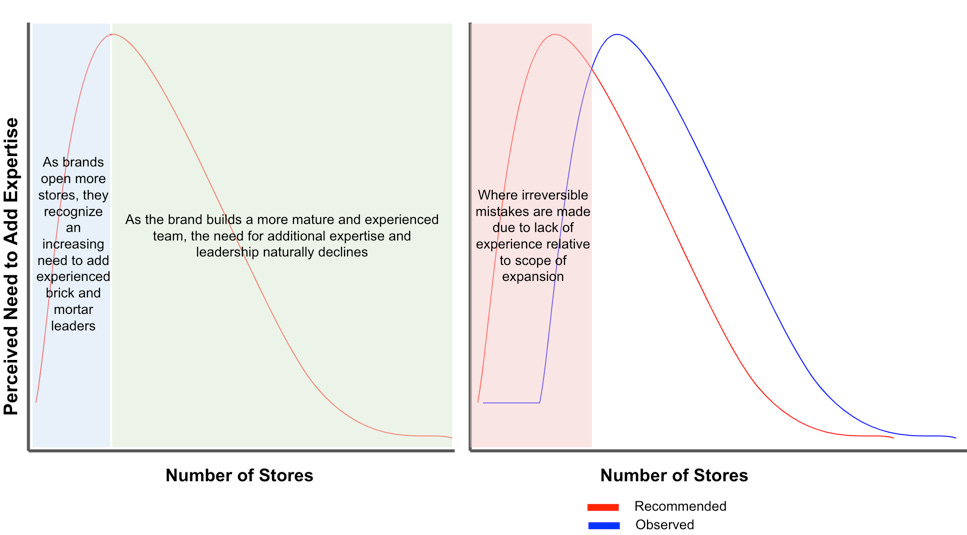

But when it comes to retail expansion, as I’ve spoken to more and more brands at various stages of their journeys, the more I’ve noticed a consistent evolution in response depending on where they are in their store lifecycles:

Brands with no stores: “I’m sure we can figure it out”

Brands with up to 5 stores: “It’s harder than we thought, but we’re learning.”

Brands with up to 10 stores: “Yeah…we made some mistakes when we started. We probably should have hired someone [in-house or consultant] sooner.”

I like to use this chart to illustrate how that “scrappy” mentality typically turns out:

There are always scenarios where staying scrappy might make sense, but it comes at a cost that I don’t think is fully recognized because it’s hard to quantify. And the irreversible nature of real estate decisions seem to come as a surprise to many.

(As a quick aside, I worked with a brand who thought they could just exit a lease penalty-free because they weren’t hitting their sales pro forma. As a reminder, leases are contractual obligations; unless you have an Early Termination right, you are obligated to pay the rent through the term of the lease or risk default — in which case you may get hit with a penalty to pay all remaining rent obligations immediately and at once).

So in an effort to help brands build a business case to decide if/when to bring in an experienced operator, I tried my best to quantify their impact by asking a simple question: What if you could do 5% better with an expert? Or asked another way: What’s the cost of being 5% worse by staying scrappy?

Below I’ve attempted to quantify what just a 5% swing could look like across timelines, budgets, and negotiations. Then I’ll leave it up to you whether you think an expert is 5%, 10%, or 15% better than an inexperienced operator.

TIME IS MONEY

“Time kills all deals” is a saying most real estate professionals live by.

Time is one of the most important things to measure in retail rollouts: landlords get impatient if negotiations take too long, lawyers rack up legal fees if negotiations take too long, and you lose precious sales-generating weeks the longer anything takes leading up to opening.

From the moment you start your real estate search to the point you open, the entire project lifecycle can take 6-12 months, which means you have ample opportunities to make up or lose time. It’s a long period of time where so many things can go wrong, and where an expert would be needed to pivot when inevitable obstacles arise.

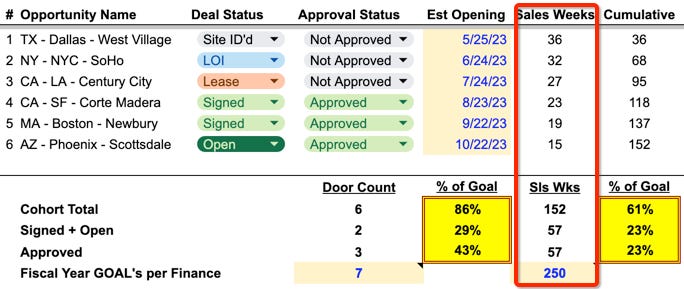

One of the most valuable metrics in gauging your pipeline progress as the year progresses is “New Store Sales Weeks” for the current year (the amount of weeks the store is open in the current fiscal year).

So for example, if your store is slated to open halfway through the year (6/30/23) then you’ve unlocked 26 out of 52 possible sales weeks. I like to track my pipeline using this dashboard, which quantifies new store opening progress in a great way:

This is important because it’s the basis of how we’ll measure the impact of a leader on project management (and implicitly how they set timeline expectations with Finance, which can be just as valuable especially if you’re managing cash closely).

Let’s start with a few assumptions about the unit economics of 1 store so we can start quantifying things:

Annual store sales: $1,000,000

Operating margin: 20%

Operating profit: $200,000

Opening date: 6/30/23 or 26 sales weeks (50% of annual)

Cash generated in fiscal year: $200,000 x (26/52) = $100,000

With these assumptions, opening 5% faster would generate an incremental $5,000 (5% x $100,000) in the store’s opening year.

That 5% improvement can come from a number of areas across the timeline:

Site selection: spend less time evaluating locations or landlords that are unlikely to come to fruition; experienced leaders know where and when to pivot the search and weed out incompatible spaces. They also know how to wrangle and manage brokers, whose interests are not always aligned with yours.

LOI negotiations: know when/which terms to punt to lease negotiations; experienced leaders know how to keep negotiations moving quickly without belaboring points that will never work on either side.

Lease negotiations: no deal will ever be perfect; know which points to give up in a negotiation and which ones matter; delays here cost legal fees and time (landlords generally won’t let you start touching the space or moving stuff in until the lease is signed)

Buildout timeline: hiccups are inevitable; experienced leaders have backup plans, know ways to expedite things, and generally how to pivot on a moment’s notice

Turnover timeline: once construction is complete, it takes time to coordinate across visual merchandising and operational teams to move product and systems in; experienced leaders know how to rally and wrangle cross functional teams on-site, and knock out items well ahead of then to keep this timeline to a minimum. This applies to vendors too.

MONEY IS…MONEY

Opening a store requires managing enormous amounts of expenses: the buildout, the fixtures and other installations (eg lighting), the rent you’re committing to, the terms of early lease terminations, and even buildout financing.

And every store is different — so not only is the channel leader managing individual projects that vary across the board, but also ensuring that one project going over/under can be compensated by another project going under/over.

And to make matters more complicated, store rollout programs are often supported by enormous vendor networks: general contractors, architects, specialists (eg signage), service providers (eg expeditors), and the list goes on. Here are some tangible areas where experienced leaders can likely get you better terms or execute better:

Rent negotiations: knowing what is “market” and how to negotiate it can save you a lot of money — especially when you consider how (a) leases can be negotiated with creative rent structures, and (b) experienced leaders will know which landlords care about one deal point more than another, enabling you to maximize what you care about most.

The average lease rents across most DTC brands’ portfolios I’ve seen is ~$100psf with 3% annual increases. Assuming your store is 2,000 square feet, that’s $200,000 per year or ~$2.3m over 10 years. Negotiating 5% better economics would save you $10,000 per year or $115k over the life of the lease.Tenant allowance: similar to rent, this is a deal point that can be negotiated. A common deal structure is to match the rent with the tenant allowance. So to be consistent with the above, $100psf x 2,000 soft = $200,000, which would mean a 5% improvement = $10,000.

Buildout costs: hiccups are inevitable and budgets are never exact until you get your specialists into the space to get their eyes on it. This means that an initial budget tends to be somewhat of an estimate based on experience. This also means that change orders are common in a buildout, and an experienced leader will know how to (a) budget for them (or release the funds back to Finance), and (b) how to keep those “surprise” costs down when they arise.

Once you’re building “real” (ie not popup) stores, the total gross cost can be hundreds of thousands of dollars. If your total gross cost (before tenant allowance) is $400,000 ($200 per square foot), then a 5% improvement would save you $20,000. Whether that improvement is actual dollars in the bank, or simply manifests itself as more precise budgeting, both are valuable for brands with limited cash.Vendors, consultants, and service providers: building stores is arguably the most vendor-heavy project a brand can undertake. A robust retail expansion program can mean you’re managing dozens of vendors. This also means dozens of opportunities to get ripped off, get delayed with elongated execution, and be on the receiving end of erroneous billing (more common than you think).

The total vendor pool’s cost can vary widely, but it wouldn’t be wild to spend up to $50,000 in non-buildout vendor costs (attorneys, consultants, store maintenance services, etc.). This is another $3,000 per location that can be avoided or saved.

A 5% swing in either direction can cost or generate $50,000…per lease

5% doesn’t sound like much — as either (a) what you need to believe an experienced leader can deliver vs an inexperienced leader, or (b) as that big of a deal. But when you add it all up…

Opening timelines: $5,000

Rent negotiations: $10,000 per year or $115,000 over life of lease

Tenant allowance negotiations: $10,000

Buildout costs: $20,000

Vendors, consultants, and service providers: $3,000

…it’s nearly $50,000 — per store! And that’s not even counting the future years of poorly negotiated deals (rents are locked in for the term of the lease). Mistakes — or opportunity costs — get expensive as you scale.

And if you’re building a store prototype or design for your first store ever, then you’ll have to consider a whole additional set of timelines and costs.

Now for what we can’t measure

$50,000 per store only reflects the first 12 months of what 5% can mean — and of what we can tangibly quantify. But there are a number of other things that an experienced leader impacts in ways that are meaningful, but a little tougher to quantify. Much like brand marketing, just because it’s hard to quantify doesn’t mean it’s worth zero.

Here are a few notable areas where experienced leaders bring meaningful value:

Messaging: when you hire an experienced leader, you communicate internally and externally that you’re investing in your retail channel seriously. This builds confidence and alignment internally on the strategy and importance of the channel, and in a similar way this also applies to landlords and investors. Building a retail channel is an enormous undertaking, and its success is definitely amplified when everyone believes in, and is inspired by, it. 15 years ago, would you have believed a brick and mortar retailer was taking e-com seriously if they didn’t have a single technology leader?

Internal cross functional support: as one of the most cross functional undertakings a brand can take, retail expansion requires support from literally every team in the company. An experienced leader will know how to inspire and wrangle across team lines to maximize the likelihood of great execution and morale when things inevitably get chaotic and stressful.

Reputation and relationships: real estate is a relationship business. That means your reputation among landlords and brokers can help — or harm — the deals you get and the quality of them. An experienced leader can (a) bring their reputation with them, and (b) prevent you from destroying your own because of the silly missteps you take. Part of getting great deals is instilling confidence and excitement in landlords, and an experienced operator will be able to do so with ease.

Poor performance: and most obvious of them all, great execution doesn’t mean great performance. You may be the most process driven company out there and hit all budget and timeline goals. But if you pick a bad location, then it doesn’t matter — your store is still going to suck.

(When) are they worth it?

This is the cutoff point — if you want to be conservative and only base this on what you can directly measure — at which an experienced leader will at least pay for themselves in the first 12 months:

Average salary of Sr Director / VP Store Development = $180,000 - $220,000 salary

Plus bonus, benefits, fringe, etc. = $300,000 - $350,000Average cost of 5% = $50,000 —> 6-7 stores per year

That assumes a very conservative 5% “cost of scrappiness” which is…forgiving (and devalues the experience of seasoned operators!). I’m not sure what the right number is, so here’s a few ways to look at it:

5% cost of mistakes = requires 6-7 stores

10% = 3-4 stores

15% = 1-2 stores

An alternative is to bring in a fractional Store Development leader — like 1REC!

At lower store counts where a full time hire may not make sense, a fractional leader may be a more cost effective approach to getting the best of both worlds: all the expertise at a fraction of the cost and commitment. Contact 1REC if you’re interested in learning more.