The tl;dr

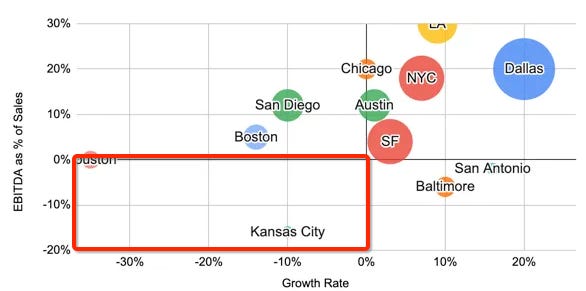

Closing stores should start with a fleet-wide audit assessing growth, profitability, and available lease actions

Past performance is a sunk cost: look at your forecasted losses as much as your past, and be sure to weigh the cost of operating vs the cost of closing; the latter can actually cost you more than the former

Be sure to consider the “hidden” costs of closures, and don’t jump the gun too early on “underperforming” new stores

Great retail requires patience and experimentation

Closing stores sucks

It’s a smear on a fleet’s resume, and it’s usually (but not always) an indication that either (a) you picked the wrong site and sales didn’t end up justifying the rents, (b) the market has changed and is no longer worth staying in, and/or (c) the store is relocating within the market. (I’m sure I’m missing a few others…)

But what’s often lost in a store’s closure is that it’s an investment: closures have a number of one time costs (cash and non-cash expenses), and with the thesis that the sum of those one time costs is less than the sum of future losses.

In other words, closing stores should result in savings that can be applied elsewhere.

But just because a store is underperforming and losing you tons of money doesn’t mean you should sprint to close it. Sometimes it’s cheaper to keep operating at a loss than incur the one time costs it takes to close it — especially if there’s a chance it could get turned around.

The store closure journey begins with a portfolio audit

A while back I wrote about how to evaluate your fleet. Generally speaking, the stores that should be considered for closure would fall in the bottom left quadrant: sales are declining year over year, and the location is not profitable:

I won’t go into the “why are they underperforming” deep dive in this newsletter, and instead will focus on the “where do we go from here” thought process.

Evaluating the “cost” of operations

By definition, if a location falls in the bottom left quadrant, it’s losing money. In other words, maintaining operations is costing you money (and most likely will continue to do so).

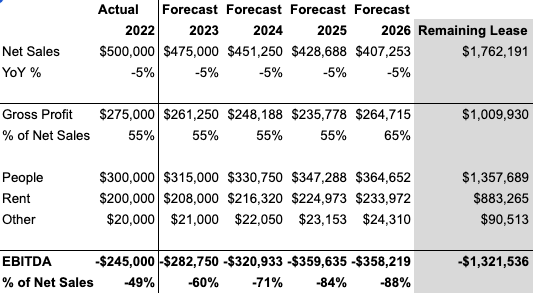

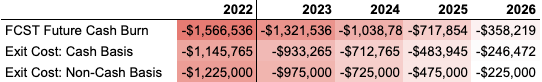

Let’s say your store’s financials look like this:

Assuming you have 4 years left, you stand to burn about $1.3m, or $280k-$350k per year. This increases in the outer years as fixed costs stay, well, fixed and revenue declines rapidly in this scenario.

The cost of exiting declines as time passes

When you close a store, you need to be mindful of a couple financial impacts:

The “breakdown” of the store: sending teams, hiring taskrabbits, and other costs associated with closing down your location — whether at lease expiration or prematurely.

Additional costs if exiting prematurely: you can exit a lease prematurely in a few ways:

(1) Exercise an early termination right: if you negotiated your lease well, you’d have included a sales-based termination right (where you can terminate on the basis of not exceeding a mutually agreed upon threshold) and/or a landlord co-tenancy requirement (where you can terminate on the basis of the landlord not achieving a mutually agreed upon threshold of tenant occupancy %). Read more about these in 1REC’s glossary!

(2) Default on your lease: you can break a covenant in your lease (eg stop paying rent), and the landlord will terminate the lease with penalties and potentially litigation.

(3) Negotiate with the landlord: not all landlords actually want you in their space: some may even want you out of the space as soon as possible (eg if they think they can fetch higher rents than what you’re paying). In those cases, they may let you break the lease penalty-free. But otherwise, you’ll likely have to pay some form of penalty.Each of these will incur some additional costs across a number of areas, which I’ve broken out between cash (straightforward) and non cash (hits your profit, but doesn’t require a cash payment):

Cash costs:

Legal fees: ask your lawyers for estimates of these

Lawyers (contracts)

Lawyers (litigation/arbitration)

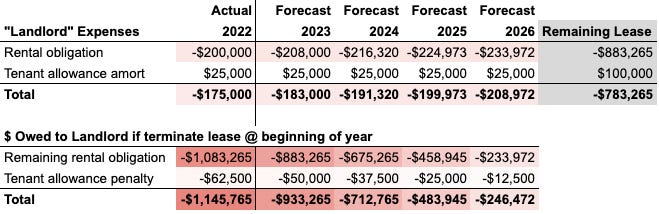

Penalties: reference your lease for these; should be spelled out clearly

Tenant allowance repayment

Remaining rent obligations

Broker fees

Security deposit

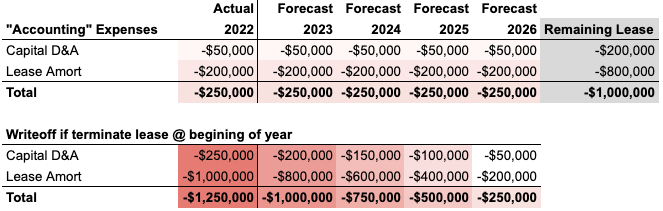

Non-cash costs: these are a bit technical so I won’t go into much detail here beyond the accounting defintions, but ask your accountant / controller about the following if/when you terminate a lease prematurely:

Lease impairment: An impairment is a permanent reduction in the carrying value of an asset below its fair value (US GAAP ) or recoverable amount (IFRS ), which occurs when it is deemed improbable that the loan or lease receivable will be recovered in accordance with the contractual terms of the loan or lease

D&A writeoff: A fixed asset is written off when it is determined that there is no further use for the asset, or if the asset is sold off or otherwise disposed of. A write off involves removing all traces of the fixed asset from the balance sheet, so that the related fixed asset account and accumulated depreciation account are reduced.

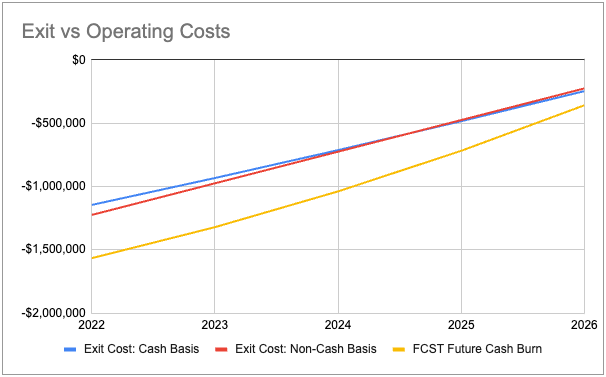

In general, the cost to exit a lease (across cash and non cash items) declines over time. I won’t go into the mechanics of all of these, but to illustrate this I’ve outlined a few below:

In short, as you approach the end of the lease, the remaining obligations decline mathematically.

Define your priority

Because there are both cash and non-cash costs associated with exiting a lease early, you’ll want to confirm what the priority is. Obviously minimizing both is great, but if you’re a well-capitalized public company then you probably care more about what the Net Income (ie profit including burden of non-cash) impact is of a lease exit more than you care about just the EBITDA or cash impact. If you’re a cash-strapped startup, then you probably care more about the latter.

Here’s how all three figures compare to each other:

As you’ll notice, the impact of continuing to operate vs terminate early converge as you approach the end of the lease. That’s because the cost to terminate is largely based on the obligation, which shrinks as you approach the natural expiration.

In this example, there is no scenario of time where it makes sense to continue operating: at all points leading up to the lease’s natural expiration, the anticipated future cash burn is worse than both the cash and non cash costs to terminate early.

However, it’s worth noting that my oversimplified approach is omitting a few things:

Keep reading with a 7-day free trial

Subscribe to Clicks to Bricks: The Playbook to keep reading this post and get 7 days of free access to the full post archives.