The Store Development Vendor Stack

The complex vendor network you'll need to build as you open and operate stores

The tl;dr

Opening stores requires an extensive vendor network and tech stack

Even once you’ve established scale and have full time hires, managing a network of stores is similar to managing a network of companies with some shared vendors and some state- or even store-speciic

Read on for some details of which key vendors you should keep in mind

Or explore the Resource Hub’s filterable list

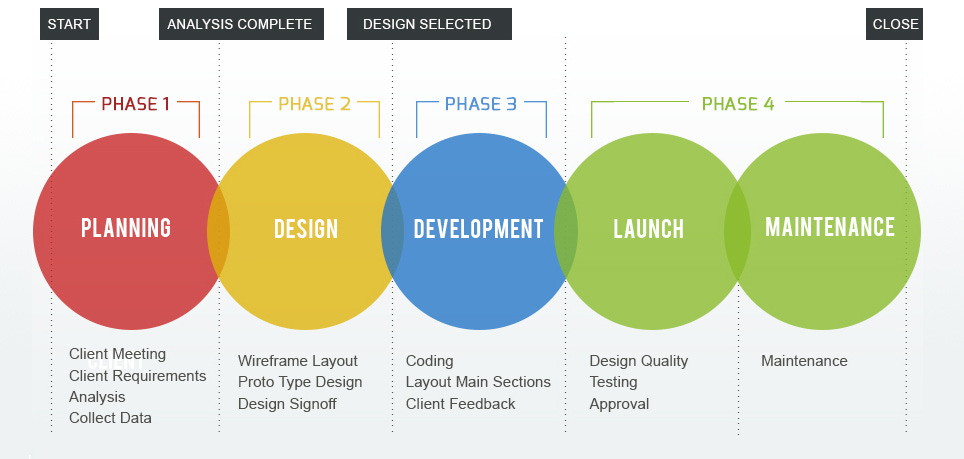

The Store Development Process

With the rise of e-commerce, a couple of visualizations have become commonly mapped, marketed, and even pitched in fundraising efforts: data lakes and tech stacks.

In both of these cases, these types of diagrams usually illustrate the flow of inputs and outputs. These have become popular in e-commerce because they simplify the rather complex processes and networks that power the technology behind the website.

Store development is an equally complex process, yet there isn’t quite as much out there in the way of simplified process mapping, vendor networks, etc. (at least publicly).

I’ve explained how the store development process works, as mapped to a typical organizational structure, and this deep dive will build on that by providing a point of view of how your retail “tech stack” should look across the same four core functions:

Retail Strategy & Finance

These functions tend to answer the when, where, and why that fuels retail expansion planning. Some core questions that these teams answer are:

How many stores should we have?

Where should we have them?

How much will these cost?

When should we open in a market?

Thankfully, many of these questions can be answered using first party data and tools that your company likely already has (although it may take some data manipulation). These are the types, and examples of, tools and vendors that can be helpful as you answer those above questions:

Geospatial Information Systems (GIS): These tools help you visualize and extract location data such as shopping destinations, existing brand and competitor locations, and trade areas. Tableau has basic GIS capabilities and is inexpensive, while ESRI is the dominant tool for many. Placer.ai is becoming a hot vendor in the space, using aggregated mobility data to visualize “True Trade Areas (TTA).” Many of these tools also offer access to data marketplaces where you can buy things like tapestry segmentation data.

Geocoders: This type of tool is primarily in conjunction with GIS platforms, and is a type of service that assigns an exact latitude and longitude coordinate to a given address. This is important for two reasons: (1) data visualizations (dot maps are more informative than heat maps), and (2) geospatial analysis (for exact distance calculations as you define trade areas and analyze cannibalization potential). Many GIS platforms

BI data tools: These aren’t necessarily required, but are incredibly helpful in, extracting raw data for reporting, analysis, and forecasting — all of which are critical inputs to map existing customers in GIS platforms and to conduct other types of customer analyses. In my past, I’ve used Looker and Tableau most extensively.

Retail real estate consultants: These are often also your real estate brokers (so their incentives might not be perfectly aligned with yours), but they have great knowledge of the retail landscape including real estate inventory, deal structures, landlords, and the overall market. They can help you plan the offline expansion strategy — just be sure to check their work with unbiased leaders if available.

Competitor data: There a few vendors out there that sell location data, along with various attributes of the location lists. For example, ChainXY sells datasets that can include a list of all of Nordstrom’s locations, broken out between full price and outlet, with the full address, and various other attributes. This can be incredibly helpful as you benchmark how many stores you think you can have nationwide or even in a CBSA.

Financial modeling: Unfortunately no team can get away from spreadsheets, and these teams are no exception. MS Excel or Google Sheets are the primary tools for this type of work. And while there aren’t any notable retail-specific financial planning tools, there are a number of FP&A software tools and excel plugins that have modules you can customize for retail planning.

Real Estate & Lease Administration

These functions are primarily responsible for the execution and management of real estate deals, and are often provide critical input to the strategy team in the form of timelines, estimated deal structures, and location roadmap. Much of this work doesn’t require many tools, but requires a strong network and a few key vendors. These teams tend to answer:

Where should we be opening stores?

Which landlords are offering the deals we need?

What are market rents in our target markets?

How much exposure do we have with a current landlord?

What are deal comps and precedents with a certain landlord?

Because many of those questions are predicated on access to information, it’s no surprise that the most critical “vendors” are those that provide a means of getting that information:

Brokers: Depending on how your team is set up, these may actually be in-house. Otherwise, these partners are the boots on the ground deal-makers, providing you access to landlords, deal comps, and sometimes sales comps from existing tenants. At their core, they are liaisons between brands and landlords, and often hold state-specific licenses. For this reason, you can often choose to build your broker network in one of two ways: (1) use a master broker who accesses real estate nationwide by tapping into and managing a collection of local brokers (easier to manage but creates another layer), or (2) build and manage your own local broker network (tougher to do and requires established broker network)

I live in NYC, so I always recommend Retail by MONA or RKF as great local partners locally.Landlords: These are not just the folks on the other side of the table, they’re also critical partners in helping you build your offline expansion strategy. Much like brokers, they also have access to deal and sales comps. They can also act as financing partners by offering to pay for some of your buildout costs (as a reimbursement after opening) in exchange for higher rents.

Deal / project management software: If you’re opening 20 stores in a year, then you’re probably chasing upwards of 60 with the expectation that many of them will fall out for some reason or another. With so many landlords, addresses, deal statuses, and timelines floating around, you’ll need a project management tool to keep track of it all. Many operators just use MS Excel or Google Sheets, but there are also basic project management tools like Asana, or real estate specific tools like Occupier, that can be even more helpful.

Real estate attorneys: Sometimes these functions are either partially or fully in-house, but it’s more common to see these outsourced since deal flow can ebb and flow. Leases are complicated legal documents that can be 100 pages or more. Negotiated well and these can save you tens of thousands of dollars, but if signed without rigorous negotiation and they can cost you even more in those rare times when legal documents need to be referenced.

Lease administration software: These aren’t typically needed until you’ve reached around 20-30 leases, but this software is how you’ll manage your growing repository of hundred page legal documents. Some real estate brokerage firms also offer lease administration services, like JLL. Imagine you have 100 leases and an executive asks which ones have expiration dates in the next 180 days: it’d be foolish to spend your time reading through and interpreting the dates language in the leases, and you might not be able to trust a spreadsheet that’s been handed down across “generations” of team leaders. Lease admin systems are essentially databases for your leases that you can query. But keep in mind the results of these queries are only as good as the translation process was to get the lease converted from a word doc to a database. Which brings me to the next type of vendor: lease abstraction services.

Lease abstraction services: These are complementary to lease administration systems, in that they are the services that convert your lease word docs into a query-able database. Generally these are outsourced to other countries given it’s a pretty straightforward process. (I suspect AI will disrupt much of this!)

Docusign or Adobe: This sounds silly to add as a vendor, but is an absolutely critical tool in the post-COVID world. Many leases used to require “wet-ink” signatures (and some still weirdly do), but most landlords accept electronic signatures these days — saving you upwards of a week or two in some cases.

Store Design & Construction

These are the most straightforward functions in terms of what they do: they design and build the stores. However, their vendor networks can be among the most complicated: different cities, states, and countries have their own unique regulations and red tape, which consequently means these vendors are often highly fragmented. Much like the relationship and dynamic between “master” and “local” brokers, there are General Contractors (GCs) and Subcontractors (subs) — you may not have to manage the latter if you have the former. Especially in the early days of store expansion, these functions are typically outsourced since their workloads are directly tied to the number of projects in flight in any given year. Some vendors include:

Store design firms: Especially if you’re in the “genesis” stage of building out your offline prototype, you’ll likely want to hire a store design firm. These partners will help you translate your digital brand into the physical form, developing points of view on everything from color palettes to wall trims and floor finishes. And most importantly, they can often also help you source and budget everything they’ve designed.

Architects: Depending on the scope of your buildouts, your store will need architectural designs that include technical details and illustrate certain compliant features. These firms can also be store designers, helping you both develop prototypes and essentially copy-pasting-modifying prototypical designs for each opportunity. Compliance and standardization are both critical to scaling an offline program, and architecture and design firms help you with both.

Millwork vendors: Building out a store includes building out or sourcing millwork, which includes fixtures, shelving, etc. These vendors can help you design, build, and improve upon custom pieces that are uniquely yours, and/or fit your unique dimensions.

Design software: With enough scale or locations, it will eventually make sense for you to bring some talent in-house to save money and increase speed/flexibility. And with this internalization, you’ll also need to provide those employees access to software to help them design spaces with precise measurements, and ideally in 3D. The most common example of this type of software is AutoCAD.

General contractors: When you think of construction, these are vendor partners that actually do it. These firms source materials, manage the demolitions and construction, installation of fixtures, and everything in between. They’ll typically project manage most, if not all of, the buildout and hire sub-contractors to support their own bandwidth and specialization needs. While you can certainly google search for these vendors, you’re better off trying to source them through your network where you can validate their quality and costs. It’s recommended to have a number of GCs in your network, so that you can put out a few RFPs and diversify your vendor network — it’s never wise to put all your eggs in one basket with a vendor, but you should also try giving a GC repeat business so you can negotiate costs down and so they can operate smoother as a trusted and familiar partner.

MEP Surveyors: Before signing a lease, you should always conduct a formal MEP survey. This stands for Mechanical, Electrical, and Plumbing — which is essentially the building’s underlying infrastructure, and some of the most expensive components of a building to replace or repair, so it’s important you know it all works.

HVAC maintenance: Heating, Ventilation, and Air Conditioning is another incredibly expensive part of your building that you’ll want to have vendors for. Whether that’s to source or repair them, you’ll want a few people in your rolodex here.

Signage: This particular aspect of a store’s structure is unique in a number of ways. Some locales require permits just for signage, and most landlords explicitly require approvals for your signage designs. With that in mind, there are many vendors who specialize in this niche.

Permit expediters: Every building department jurisdiction has its own permit application process, which can take varying amounts of time depending on where your project is. It can be a complicated and cumbersome process, so teams often hire an expediter who can speed things up for you.

Project managers/coordinators: With the amount of vendor types listed above combined with dozens of projects across the country, it should come as no surprise that Project Managers or Coordinators are often hired for additional support. Managing your invoices, landlord allowance collections, timelines, and internal stakeholders can get complicated extremely quickly, and these partners help you stay organized, on budget, and on time.

Specialty: In a buildout, there are some things that you may think are simple but inevitably get wrong: such as lighting. Picking and placing light colors, brightness, etc. is an art and science, and sometimes may require an expert to help.

Store Operations & Leadership

These two functions are what most people think of when they hear retail: the corporate folks who support ongoing store operations, and the front line retail workers. Store operations is an incredibly wide ranging function, which can include everything from facilities maintenance to visual merchandising to technology implementation to inventory logistics, so we’re listing a wide range of vendor types in this one.

Visual merchandising (art, decor, plants): Sometimes this is outsourced, but often in the beginning days this is just managed by a combination of the store team, the marketing team, and occasionally your (outsourced) store designer. This person/team/vendor ensures that your product is displayed appropriately, efficiently, and strategically. They also typically have a keen eye for other design elements for a store, including art, plants, and other decorative items.

Third Party Logistics (3PL): Depending on how your operations team manages things, you may need an additional 3PL vendor that specifically manages the flow of inventory to and from your store.

Workforce management and communications / intranet: When operating stores, there’s a slew of things that need to be tended to every single day: opening the stores, packing and unpacking inventory, scheduling, tidying up the store, moving cash, etc. With one store that might be easy to manage, but across multiple that can get really challenging very quickly. There are a number of tools out there broadly categorized as Workforce Management (WFM), but in the beginning days (first 20 stores) you’ll likely just want to use google sheets.

Learning & Education: While similar in appearance, Learning & Education platforms are different in their use case. Think of these tools as a hybrid of a company intranet and digital courses.

Facilities & maintenance: Managing stores means you’re managing buildings. Which come with some unique maintenance requirements that e-commerce doesn’t have, and even with an office may only have to a limited degree: HVAC repairs, bathrooms and plumbing, ceiling tiles, security systems, etc. This can typically be managed in one of two ways: (1) direct connections with vendors or (2) through a platform like REM Facilities & Maintenance. You’ll pay a premium for the latter, but it will save you a lot of time and potentially budget hiring a full time employee.

Office supplies: This may sound silly to list as a vendor, but you’ll be purchasing quite a few things in this category, and at certain volumes you shouldn’t be doing so at retail. Partners like Office Depot will generally give you volume pricing.

Security: Shrink is becoming a much bigger concern these days, so it’s important to have proper security for your store. ADT is the typical camera provider, but a number of others exist out there. Be careful though, as many residential security systems are not scalable solutions for retail.

Wi-Fi: This may also sound obvious, but it’s important to call out because sometimes landlords (primarily malls) will require you use their provider. And as with a lot of things in retail, you can get volume pricing with certain providers.

POS: Point of Sale providers are critical to operating a store. Square is the most obvious one, but sometimes (especially if you’re a showroom), you may want a more tech advanced solution. Tulip has gained significant traction among among DTC brands as a favored solution.

In-store analytics: Despite stores’ offline nature, with the right tools you can very much analyze your physical store in a similar way as you would your online store (heatmapping, dwell time, journey mapping, etc). RetailNext is my personal favorite.

Experience (music, scents): This may also sound pretty straightforward, but is often overlooked. Music technically must be properly licensed, meaning that you can’t actually just play a Spotify Premium account in a commercial setting. Spotify does have a commercial offering specifically for this reason. On a different note, but on the topic of in-store experiences, it also helps to invest in a retail “scent”. Unlike online, in an offline environment you can and should consider an olfactory experience: it can significantly influence your customer experience!

PS - If you’re a vendor and would like to get added to the directory, drop me a line! (andrew@1rec.co)